The 10-Second Trick For Transaction Advisory Services

Table of ContentsNot known Factual Statements About Transaction Advisory Services Excitement About Transaction Advisory ServicesThe smart Trick of Transaction Advisory Services That Nobody is DiscussingThe Transaction Advisory Services PDFsThe 25-Second Trick For Transaction Advisory Services

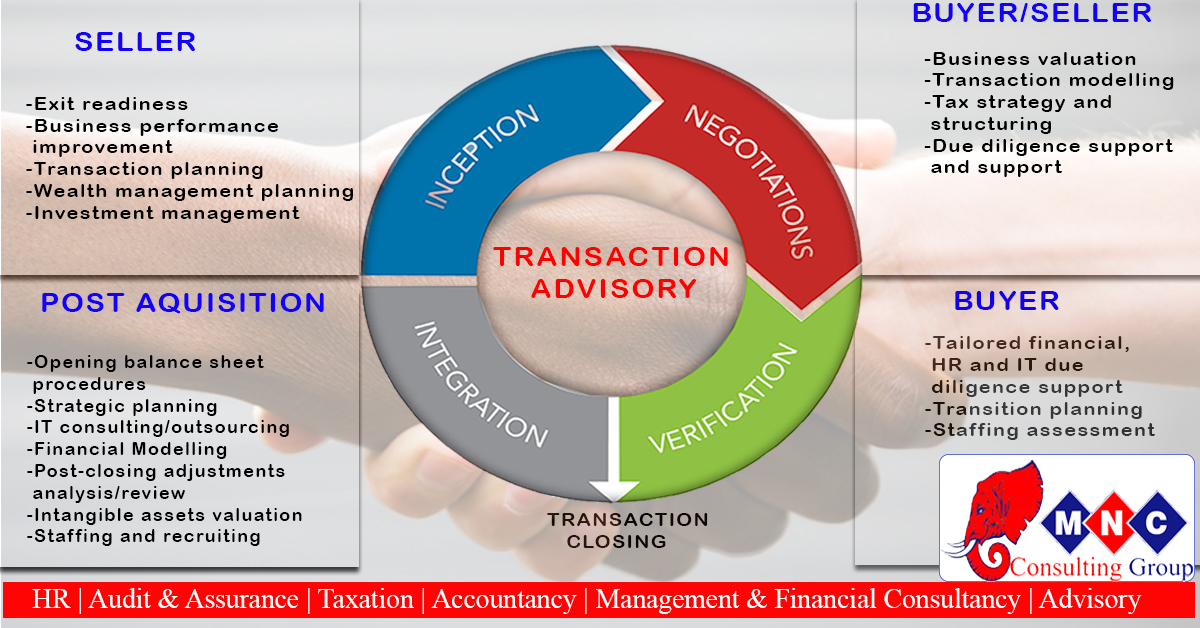

This step makes certain the business looks its best to possible buyers. Getting the organization's worth right is crucial for an effective sale.Transaction consultants action in to aid by getting all the required info arranged, responding to inquiries from customers, and setting up check outs to the company's location. This develops trust fund with purchasers and maintains the sale relocating along. Obtaining the finest terms is essential. Purchase advisors use their expertise to assist local business owner manage challenging negotiations, satisfy purchaser assumptions, and framework deals that match the proprietor's goals.

Satisfying lawful regulations is vital in any type of service sale. Deal consultatory services work with lawful experts to produce and evaluate agreements, contracts, and various other legal papers. This minimizes risks and makes certain the sale complies with the regulation. The role of deal experts expands beyond the sale. They help company owner in preparing for their next steps, whether it's retirement, beginning a new endeavor, or handling their newly found wide range.

Deal experts bring a riches of experience and expertise, ensuring that every aspect of the sale is managed professionally. With critical preparation, evaluation, and negotiation, TAS helps company owner achieve the greatest feasible price. By ensuring lawful and regulatory conformity and handling due diligence alongside various other offer employee, deal experts decrease prospective threats and responsibilities.

See This Report about Transaction Advisory Services

By comparison, Huge 4 TS groups: Job on (e.g., when a potential customer is performing due diligence, or when an offer is shutting and the buyer requires to integrate the firm and re-value the seller's Equilibrium Sheet). Are with fees that are not connected to the bargain closing effectively. Gain costs per involvement someplace in the, which is less than what investment banks make even on "tiny deals" (yet the collection possibility is also much greater).

, but they'll focus much more on bookkeeping and appraisal and less on topics like LBO modeling., and "accountant only" topics like test equilibriums and exactly how to stroll with events using debits and credit histories rather than financial statement modifications.

The Basic Principles Of Transaction Advisory Services

Specialists in the TS/ FDD teams might likewise speak with management regarding every little thing over, and they'll write a thorough report with their searchings for at the end of the procedure.

, and the general form looks like this: The entry-level duty, where you do a great deal of information and monetary evaluation (2 years for a promotion from right here). The following degree up; comparable job, yet you obtain the more fascinating little bits (3 years for a promo).

In particular, it's challenging to obtain promoted past the Supervisor degree because couple of people leave the task at that phase, and you require to start revealing evidence of your capacity to create revenue to advancement. Let's start with the hours and way of life given that those are simpler to explain:. There are occasional late nights and weekend break job, however nothing like the frantic nature of investment banking.

There are cost-of-living adjustments, so expect reduced payment if you remain in a less expensive place outside major economic centers. For all placements except Partner, the base income consists of the mass of the overall compensation; the year-end benefit may be a max of 30% of your base pay. Typically, the most effective method to increase your earnings is to change to a different firm and bargain for a greater wage and perk

The smart Trick of Transaction Advisory Services That Nobody is Discussing

At this phase, you need to just stay and make a run for a Partner-level role. If you desire to leave, maybe move to a client and execute their valuations and due diligence in-house.

The main trouble is that because: You normally need to sign up with one more Big 4 Your Domain Name team, such as audit, and job there for a few years and after that relocate right into TS, job there for a couple of years and after that move right into IB. And there's still learn the facts here now no warranty of winning this IB role because it relies on your region, customers, and the employing market at the time.

Longer-term, there is additionally some danger of and because evaluating a firm's historical monetary details is not exactly brain surgery. Yes, humans will constantly require to be included, however with more advanced innovation, lower head counts might possibly support client interactions. That said, the Transaction Services group beats audit in terms of pay, job, and leave opportunities.

If you liked this article, you could be curious about reading.

The Definitive Guide to Transaction Advisory Services

Create advanced monetary frameworks that aid in identifying the actual market value of a company. Provide advising job in connection to business assessment to assist in negotiating and pricing frameworks. Discuss the most ideal type of the bargain and the kind of factor to consider to employ (money, stock, earn out, and others).

Establish activity prepare for risk and direct exposure that have actually been recognized. Perform combination planning to establish the process, system, and business modifications that might be required after the bargain. Make mathematical estimates view it now of combination costs and advantages to examine the economic reasoning of assimilation. Establish standards for integrating departments, innovations, and company procedures.

Analyze the prospective customer base, industry verticals, and sales cycle. The operational due persistance uses important insights right into the functioning of the firm to be obtained concerning risk evaluation and value creation.